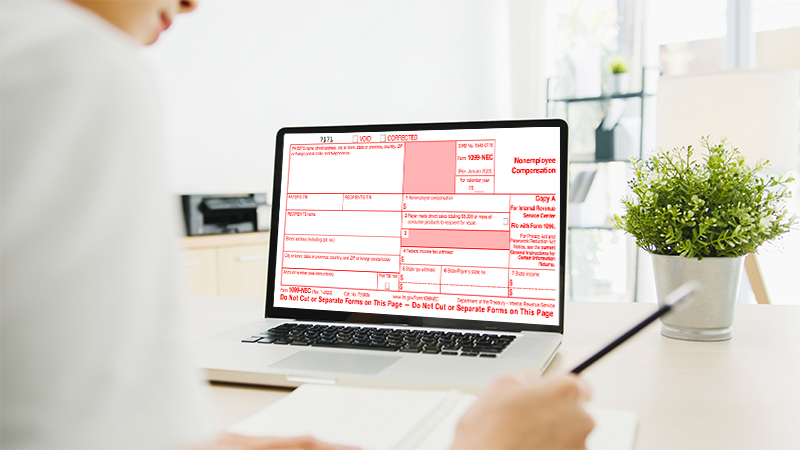

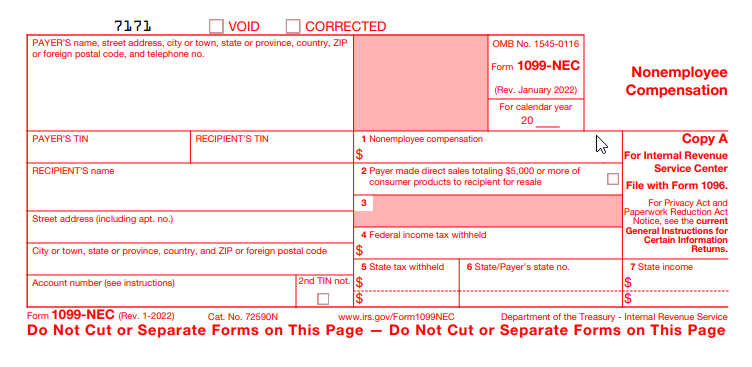

What is Form 1099 NEC?

Form 1099-NEC is used to report nonemployee compensation. If Any payments made of $600 or more to an independent contractor must be reported on IRS Form 1099-NEC.

Why do you need a Form W-9 to report Form 1099-NEC?

Form W-9 is used to "Request for Taxpayer Identification Number and Certification" to obtain names, addresses, and taxpayer identification numbers (SSN) from people you will be required to provide Form 1099 NEC.

Visit https://www.taxbandits.com/what-is-form-w9/ to learn more about Form W-9.

Due Date to File Form 1099-NEC for 2024 Tax Year

Recipient Copies

January 31, 2025

Electronic filing

March 31, 2025

Paper Filing

February 28, 2025

The deadline for 1099 NEC will vary for states. Check out the state filing requirements for 1099 Forms.

Get started with TaxBandits today to e-file Form 1099-NEC before the deadline and avoid any unnecessary Penalties.

Why Choose Us for 1099-NEC Electronic Filing?

Get Started to File Form 1099 NEC with the Simple, Quick, and Time-saving Features

TIN Matching program

Avoid filing corrections due to wrong TIN information. Our TIN Matching ensures your

1099 Forms are TIN error-free.

We Postal Mail your

recipient copies

Once a return has been filed with the IRS, we print and send hard copies of Form 1099 to your recipients with our

postal mailing feature.

Excel/CSV Upload for

Bulk Filers

Instead of inputting your individual recipients' details, upload all your recipients' information in Excel/CSV and

file 1099 NEC instantly.

Import 1099 Data from

Accounting Software

Seamlessly integrate data from Xero, QuickBooks, Zoho Books, and FreshBooks and e-file your 1099-NEC instantly without any hassle.

Get Access To Lot More Amazing Features Right Now

Fill out and submit your W-9 online.

Fill out Form W-9 electronically securely through TaxBandits. Users must fill in their required information, such as name, address, TIN, and Federal Tax Classification. After signing, they can review and edit the information and can download or share the form via TaxBandits. The form can be sent directly to payers or printed and distributed.

Steps to Filing 1099-NEC Electronically

Form 1099-NEC can be e-filed or paper-filed with the IRS. However, the IRS strongly recommends that you e-file your 1099-NEC return.

To begin filing 1099-NEC just follow these simple steps Once you review and transmit your form, our team will continue to update you on its status with the IRS.

Step 1

Create a Free Account and Select “Form 1099-NEC” from the dashboard.

Step 2

Complete the form by entering the required details.

Step 3

Review the Form information.

Step 4

Transmit your 1099-NEC to the IRS and State.

Click here to know How to fill out Form 1099-NEC.

Ready to file Form 1099-NEC Electronically? Get Started Today and file your Form 1099 NEC in a few minutes!

Form 1099 Pricing

| No. of Forms (Price per-form) | First 10 Forms | Next 90 Forms | 101 - 250 Forms | 251 - 500 Forms | 501 - 1000 Forms | 1000+ Forms |

|---|---|---|---|---|---|---|

| 1099 Federal E-File | $2.75 | $1.75 | $1.15 | $1.00 | $0.80 | Contact us for Bulk Pricing 704.684.4751 |

| 1099 State E-File | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | |

| Postal Mail | $1.50 | $1.50 | $1.50 | $1.50 | $1.50 | |

| Online Retrieval | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 |

Click here to know more about 1099 E-file pricing

Frequently Asked Questions on Form 1099-NEC Electronic Filing

What is the difference between 1099-MISC and 1099-NEC

What information is reported on Form 1099-NEC?

How do I file 1099-NEC with the State using TaxBandits?

Is there a Bulk upload option for form 1099-NEC with TaxBandits?

How to schedule Form 1099-NEC filing with TaxBandits?

What is the difference between Form 1099-K vs 1099-NEC vs 1099-MISC?

What Forms 1099 are required for landlords, tenants, and property managers?

When is the 1099-NEC deadline?

Helpful Resources

Form 1099-K vs 1099-NEC vs

1099-MISC

IRS Form 1099-NEC

Form 1099-NEC Due date

Form 1099-NEC Instructions

Form 1099-NEC Mailing Address

Form 1099-NEC Penalties

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Request W-9 Now